It’s a brisk morning and as we approach the shortest day of the year – in the northern hemisphere anyway – and many of us will be drinking that extra cup of coffee as seasonal consumption kicks into high gear.

After an intensive run up from about $2 to $2.50 and subsequent correction to the low 230’s, the market was relatively subdued last week, closing Friday at 235 (March), up about 2 cents from the previous Friday. However, this morning as I write this, the market is already down another 11 cents so evidently the correction is not over. Unfortunately, there’s a sense this morning that the rapid resurgence of Covid – with Omicron and Delta spreading rapidly – that this cannot be positive for our economy, our business, and for that matter, our quality of life.

The exchange’s Commitment of Trader’s report, which is released every Friday and covers the week ending the previous Tuesday (Dec 14 in this instance) is interesting in that during that week, when the market was down about 7 cents, open interest declined some 14,000 contracts, about evenly split between commercial and speculative interests. We’d interpret that to mean that some of the speculators who had previously bought the market closed out their long positions; and on the commercial side, roaster price fixation was accomplished.

The technicians who bring their mathematical tools to bear on following the market’s price action would say that even with this morning’s drop, the market is still in a corrective phase of a bull market. Market remains above the long term moving averages. Technical analysis is an art that goes back hundreds of years since invented by far eastern rice traders and is predicated on the idea that the psychology that governs how traders behave when confronted with winning (or losing) positions in moving markets has never really changed in all that time. The fundamentals expressed by these technical signals are by now well known to us all – crop problems in Brazil, and shipping problems everywhere conspiring to force a drawdown in inventory stocks in consuming countries as roasters and trade scramble to find the coffees they need. In fact, US stocks as reported by the GCA were reported down last week by about 132,000 bags at November end; although this is consistent with the normal seasonal pattern, it does indicate that there was no great “catching up” as industry continues to struggle with logistical challenges. And as we reported last week, shipments from the two largest Arabica countries, Brazil and Colombia, were down double digit percentages in Novembers versus prior year suggests that a dramatic stock build this month is unlikely.

Many of us have been wondering what the signs will be when the market is ready to turn around from the current bull pattern. Here are a few thoughts:

- Market structure – when the nearby futures months are higher than distant futures months, it is a signal that coffee is tight (market pays a premium for coffee today and holding coffee for later costs the owner money). When that turns around to a more normal structure, it could be a sign that coffee is no longer tight. In early December, the premium of March to May was 1 cent/lb; today however March is at about a ¼ cent discount to May. Normal market in coffee would be closer to a 2 cents discount so we will continue to keep an eye on that indicator.

- Related to the above, consuming country stocks. As we said, they were down again in November. Look for an upswing in stocks – combined with a normal market structure – to indicate better availability of coffee. How easy or hard is it to buy spot coffee?

- Logistics – This has been a huge contributor to the current situation because if coffee exists in Santos or Buenaventura that cannot get to the users, it’s rather like the proverbial tree falling in the woods. Logistics remain problematic but not quite as bad as a few months ago. It remains to be seen if the upsurge in Covid will once again set back efforts to improve the flow of goods.

- Brazil Crop – much has been said and written about the upcoming crop, and the market is already discounting a significantly lower crop. How will it fare versus market expectations? The “fruit set” period is typically during January so the accuracy of the crop projections made over the next month or so should be that much better or perhaps a tighter consensus may emerge. Right now, there is a wide range of estimates in the half dozen ones we’ve seen so far, with the most recent estimate coming from the USDA (credible forecaster in the past) just this morning lower than the average:

Brazil crop 2022-23 Arabica Total

*Mean 43 M Bags 59 M Bags

Low 30 45

High 47 67

*Includes USDA 35 56

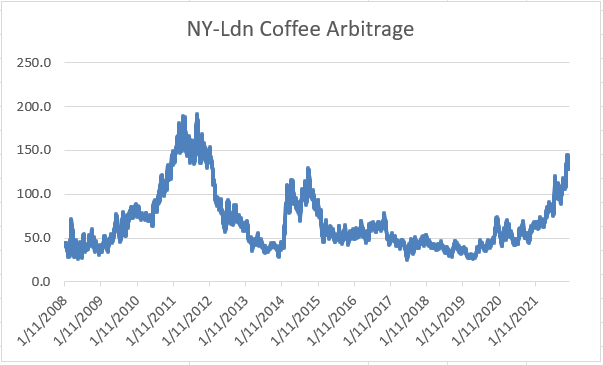

- NY-London (Arabica-Robusta) arbitrage – One thing for sure is all coffee coming out of the ground is needed by the market. And since the crop shortfalls impacted Arabica (especially Brazil) more than Robusta, the market requires a shift in consumption away from Arabica to

Robusta. This shift will then ease some of the demand pressure that is pushing NY Coffee (Arabica) higher. So, we would expect to see enough spread in the two markets to encourage shifting to cheaper Robusta beans. This may manifest itself in roasters changing blends to some extent, but probably is more likely to happen by consumers who previously bought 100% arabica brands noticing that they can buy other coffees for a lot less money. Or away-fromhome purveyors of coffee making the same observation. The arbitrage right now at about 130 cents is wider than it’s been in nearly 10 years, but in the 2011 run up, it was out to 190 cents. We are keeping an eye on Robusta demand as a sign of the market doing its work.

Armenia is working hard to overcome these challenges and be a reliable supplier to the industry. Just arrived is a Fair Trade Organic Sumatra from Gayo and we have Colombian Excelsos and Supremos, Brazil 17/18, Guatemala Hard Bean EP, and Viet Wet Polished Robusta for your consideration.

Please everybody have a wonderful holiday and do be safe and healthy in light of the latest on the Covid front.

All the best,

The Armenia Team